1. Revenue Growth & Profitability:

- Tata Power ka revenue steady growth dikha raha hai, aur company ki profitability bhi achi hai. Renewable energy sector mein unka focus kaafi strong hai, jo long-term growth ko sustain karne mein madad karta hai.

- Tata Power ne apne last kuch quarters mein achi earnings report ki hai, jo is baat ka proof hai ki company ki performance improving hai.

2. Strong Presence in Renewable Energy:

- Renewable energy (solar, wind) ke sector mein Tata Power ka kaafi bada stake hai. Renewable energy ka future bright hai, aur Tata Power is space mein kaafi invest kar raha hai.

- Company ka target hai apne renewable energy capacity ko badhane ka, aur government ke renewable energy targets ke sath yeh growth aur bhi accelerate ho sakti hai.

3. Diversified Business Model:

- Tata Power ka business model diversified hai, jo unhe market ke fluctuations se protect karta hai. Unke paas power generation, distribution, aur renewable energy ka combination hai.

- Yeh diversified approach company ko market ki uncertainties se kaafi shield karta hai aur risk ko distribute karta hai.

4. Debt and Financial Health:

- Tata Power ka debt level manageable hai, lekin jo debt hai, woh mostly capital-intensive projects (renewable energy infrastructure, power plants) mein use hota hai. Iska matlab hai ki unke paas future growth ke liye necessary investments hai.

- Company ne apne debt ko manage karte hue cash flow ko improve kiya hai, jo unki financial stability ko dikhata hai.

5. Government Support:

- Tata Power ko government ki taraf se kaafi support mil raha hai, khaas kar renewable energy sector ke liye. Government ke renewable energy targets aur policy support Tata Power ke long-term growth ko boost kar sakte hain.

- Infrastructure development aur smart grid technology jaise initiatives ke liye bhi government ka support unke business ke liye beneficial hai.

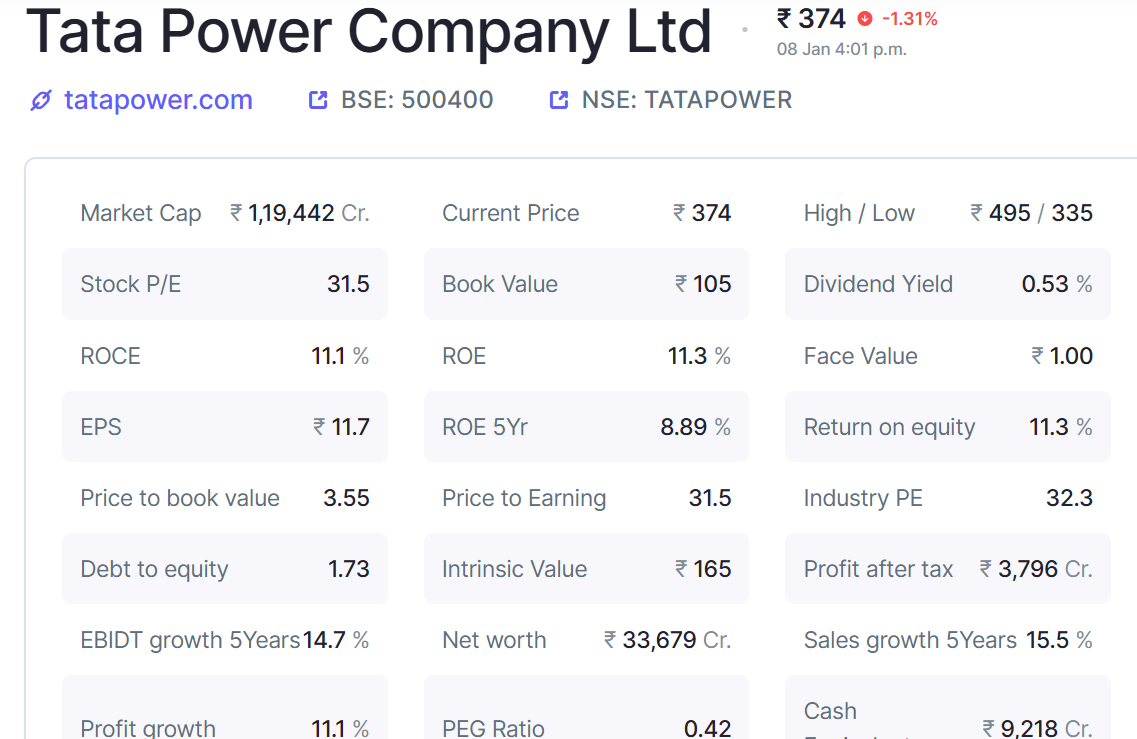

6. Return on Equity (ROE):

- Tata Power ka ROE (Return on Equity) achha hai, jo company ki efficiency ko dikhata hai. ROE ke through yeh bhi pata chalta hai ki company apne shareholders ke invested capital par achha return generate kar rahi hai.

7. Valuation:

- Tata Power ka stock kuch valuations par reasonable lagta hai, aur investors ko yeh company long-term ke liye attractive lag sakti hai, khaas kar jab company ke fundamentals strong hain aur market me growth potential ho.

8. Management:

- Tata Power ki management kaafi experienced hai, aur Tata Group ki backing bhi unke decision-making process ko aur zyada reliable banata hai. Tata Group ka reputation aur management practices Tata Power ko strategic direction aur stability provide karte hain.

9. Risks:

- Tata Power ko bhi kuch risks ka samna karna padta hai, jaise fluctuating fuel prices, regulatory changes, aur renewable energy sector ki growth uncertainties.

- Market conditions aur interest rate changes bhi unke profitability ko affect kar sakte hain, especially jab unke capital-intensive projects hote hain.

Conclusion:

Tata Power fundamentally kaafi strong hai. Unka diversified business model, renewable energy focus, profitability, aur solid financial health is company ko ek promising investment banaati hai. Agar aap long-term investor hain, toh Tata Power ka stock achha option ho sakta hai, khaas kar renewable energy aur infrastructure development ke growth potential ke chalte.

Note: Har investment ke saath kuch risks judhe hote hain, toh apne financial advisor se consultation zaroor karein.